Burns Singh Tennent-Bhohi, Co-Founder and CEO of Eastport Ventures, on how critical minerals play a crucial role in sustainability and technology.

As the world intensifies efforts to combat climate change, the urgency to achieve net-zero emissions has never been clearer.

Governments, corporations and international organisations are all striving for a future where carbon emissions are balanced by removal efforts aiming to halt global warming.

However, the journey to a net zero world isn’t solely reliant on renewable energy technologies like wind, solar, and electric vehicles (EVs). It also hinges on something more fundamental – critical minerals.

The role of critical minerals in a net zero world

These valuable commodities, including copper, nickel, uranium, rare earth elements (REEs), lithium and cobalt are the foundation of the technologies driving clean energy transition.

In short they are mission critical for efforts to rebalance the impact of deglobalising economies and trade, whilst concurrently aiding in the electrification of the world in what is the most ambitious energy transition our planet has seen in the last century.

Lithium-ion batteries, including cobalt, already power devices from smartphones to electric vehicles; copper is extensively used in electrical wiring for solar panels, wind farms, plus grid and charging infrastructure, while nickel plays a critical role in EV batteries.

Uranium is a primary fuel for nuclear power plants, which provide a significant portion of the world’s low-carbon electricity, reducing greenhouse gases and aiding climate goals.

Meanwhile, REEs like neodymium, praseodymium and dysprosium have unique magnetic and electronic properties. Their integration into solar panel design has resulted in greater efficiency in terms of sunlight absorption and resistance to extreme temperatures.

Mining: The backbone of technology

The statistical growth of the industry also illustrates mining’s role as the unsung hero behind most of the recent technological advancements. At the turn of the 20th century global production of copper stood at less than 500,000 tonnes per annum, with nickel below 5,000 tonnes per annum. In 1976 annual copper production had risen to c. 5,000,000 tonnes and annual nickel production to c. 710,000 tonnes. Fast forward to 2023 and global copper production was 22.3 million tonnes, while nickel production was c. 3.4 million tonnes.

Meanwhile, demand for rare earths has been forecast to increase by up to seven times over the next 15 years, led by the proliferation of electric vehicles and wind turbines.

A net zero future

The International Energy Agency (IEA) estimates that achieving the Paris Agreement’s climate goals will require a fourfold increase in mineral production by 2040. Electric vehicles alone use up to six times more minerals than traditional internal combustion vehicles – and a single offshore wind turbine can contain several tons of rare earth elements and copper.

Our net-zero future transitions, along with industrial and societal demand, show no sign of a reduction on the dependency of metals and mineral consumption. Indeed, as scientific research and innovation gathers pace, the adoption of clean energy technologies and the associated dependence on critical minerals is only going to increase.

The global demand for critical minerals does raise complex questions about supply chains, with many of them sourced from a limited number of regions, often in politically unstable areas or countries with questionable employment practices. For example, the Democratic Republic of Congo (DRC) produces about 70% of the world’s cobalt but is linked to child labour and unsafe working conditions.

The extraction of lithium, a key component of EV batteries, has raised concerns over water depletion in South America’s ‘lithium triangle’ which spans parts of Argentina, Bolivia, and Chile and is jeopardising local ecosystems and the livelihoods of Indigenous communities.

Similarly, China dominates the production and processing of rare earth elements, controlling over 60% of the global supply. These vulnerabilities underscore the need to diversify sources of critical minerals while ensuring that extraction and processing practices adhere to stringent social and ecological standards.

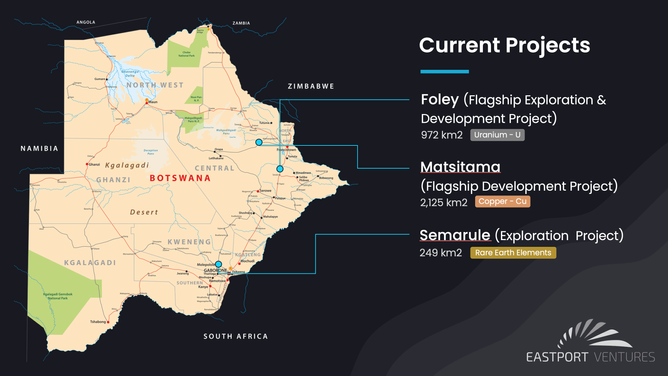

Clearly one way of reducing the dependence on China is for new discoveries of these vital commodities being made in emerging jurisdictions. As a leading developer of key copper, nickel and REEs projects in mineral-rich Botswana, Eastport Ventures is attuned to the criticality of these metals and the current geopolitical dynamics surrounding their supply.

Why Botswana?

In the renowned 2023 Fraser Institute Annual Survey of Mining Companies, Botswana was once again highly praised for its mining investment environment, ranking as the top jurisdiction in Africa and 15th globally. It performed well in both policy and mineral potential with key factors including political and democratic security, a favourable regulatory climate, strong economic fundamentals and efficient tax systems – all supported by stable governance and resource management practices.

The income generated from mining over the last 50 years has enabled Botswana to make substantial investments in social services, including healthcare and education, as well as critical infrastructure. In 2016, the government established a 20-year strategic plan called ‘Vision 2036’, which has the objective of transitioning the country from a middle-income to a high-income nation as defined by the World Bank, which would place it alongside leading countries including the USA, Canada, Japan, the UK, Qatar, and Switzerland.

Reciprocally, Eastport Ventures is cognisant of its responsibility to deliver for investors and Botswana alike and the company’s proactive approach ensures regular project news flow to keep shareholders engaged, which is crucial to attracting more capital to the sector, whilst also delivering on its in-country work commitments.

Policy, demand and the future of mining

Addressing such challenges outlined herein requires coordinated global action, backed by robust policies and technological innovations, and other governments could do worse than follow Botswana’s example and enact stricter regulations on the mining and processing of critical minerals, mandating transparency, fair labour practices and environmental sustainability.

Unprecedented demand is not going to abate any time soon, and in order to ensure that countries meet their net zero emissions targets, as committed to at COP26, comprehensive investment must be made at all levels from discovery to production to refinement.

Ensuring a secure supply of these critical metals will aid the financial viability of the rollout and adoption of renewable technologies to ensure sustainability is met globally at an environmental, economic and social level.