As AI demand soars, TSMC explores manufacturing Nvidia’s advanced AI chips in Arizona, a move set to shape the future of global semiconductor manufacturing.

As demand for AI technologies and specialised accelerator chips surges, semiconductor manufacturing is experiencing a similar surge in competition.

Taiwan, with its pivotal role in the global chip supply chain, has become increasingly crucial to semiconductor manufacturing, navigating geopolitical strains and significant legislative undertakings such as the CHIPS and Science Act.

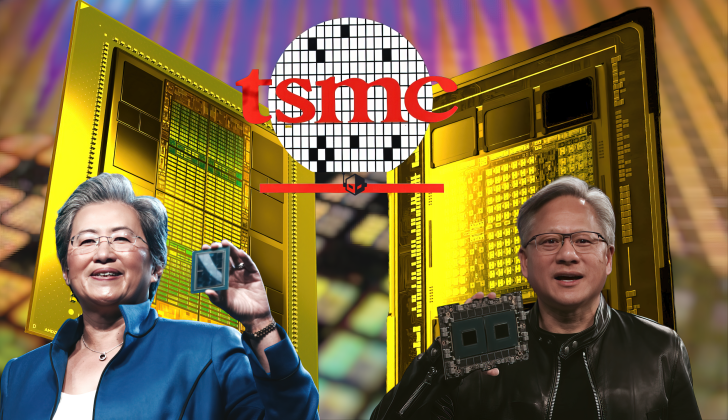

Taiwan Semiconductor Manufacturing Co (TSMC), a global leader in semiconductor manufacturing, is in fact exploring the possibility of producing Nvidia’s state-of-the-art Blackwell AI chips in its new Arizona facility.

If realised, this multi-billion dollar partnership could profoundly influence the dynamics of global semiconductor supply networks and strengthen the United States’ position in the sphere of advanced chip manufacturing.

This discussion between TSMC and Nvidia is part of a broader push by the US government and major technology corporations to build more robust and geographically varied semiconductor production capacities.

Much of the focus here has been on advanced AI processors, which are critical for global technological enhancements.

Nvidia’s Blackwell architecture has ushered in a new generation of AI processors, attracting significant interest from global manufacturing leaders and highlighting the strategic and economic importance of where chips are manufactured.

With TSMC committing an impressive US$40bn to its Arizona project, this initiative stands as one of the largest foreign direct investments in US history, solidifying the company’s presence in US semiconductor manufacturing.

TSMC & Nvidia, AI chips & Arizona

TSMC is exploring manufacturing Nvidia’s Blackwell AI chips at its new site in Arizona.

Showcased in March of this year, the Blackwell chips are designed specifically for generative AI and accelerated computing applications.

These chips have the capacity to deliver speeds up to 30 times faster than their predecessors in tasks like generating chatbot responses.

Containing an extraordinary 208 billion transistors, these chips are produced using TSMC’s bespoke 4NP process.

A successful deal between Nvidia and TSMC would supply the latter with another prominent client at its plant, joining Apple and AMD.

A deal would also fit into the existing pattern of semiconductor manufacturers expanding their US footprint.

For example Intel and Micron are increasing their operations in the United States, with Intel receiving significant funding for its factories in Arizona, New Mexico and Oregon and planning a US$20bn fabrication plant in Ohio.

Micron is also planning a substantial US$100bn investment in a memory chip plant in Syracuse, New York.

Technical and operational challenges

KEY FACTS:

- Production of Blackwell AI chips is expected to start early next year

- The chips offer 30 times faster performance for AI tasks like chatbot responses

- TSMC is investing billions in three facilities in Phoenix, Arizona

- The project has received significant US government subsidies

- This move aligns with US efforts to bring semiconductor manufacturing onshore

Manufacturing Nvidia’s Blackwell chips in Arizona presents both opportunity and challenges for TSMC.

Although TSMC intends to manage the front-end process in Arizona, the chips must be sent back to Taiwan for packaging, due to the lack of ‘chip on wafer on substrate’ (CoWoS) capability—a vital technology exclusive to TSMC’s facilities in Taiwan.

This necessity illustrates the complexities of setting up a wholly independent semiconductor supply chain within the US, despite considerable investments.

Catering to specialised demands requires a global collaborative approach in semiconductor manufacturing.

Investment in US facilities and the role of government

TSMC’s investment extends beyond one facility; it includes three facilities in Phoenix, supported greatly by US government funding aimed at reviving domestic semiconductor manufacture.

This strategy is part of the broader US agenda to enhance its chip production capacity and decrease reliance on foreign manufacturers.

The CHIPS and Science Act, established in August 2022, has been foundational in this strategy, providing US$52bn in subsidies for semiconductor manufacturing.

TSMC itself has secured US$6.6bn from the US government for its Arizona operations.

This funding demonstrates the extensive investment required for advanced semiconductor manufacturing and underscores the continuous need for collaboration between the government and the private sector to maintain global competitiveness.

In 2022, TSMC allocated a staggering US$44bn to enhance its chip-making capabilities, demonstrating the significant investment that cutting-edge semiconductor production necessitates.